With the $1.2 trillion student loan crisis accelerating, President Barack Obama gave a nod in his State of the Union speech to the millions of young Americans starting their adult lives in crushing debt but offered no new proposals for relief.

"We're shaking up our system of higher education to give parents more information, and colleges more incentives to offer better value, so that no middle-class kid is priced out of a college education," Obama said Tuesday night. "We're offering millions the opportunity to cap their monthly student loan payments to 10 percent of their income, and I want to work with Congress to see how we can help even more Americans who feel trapped by student loan debt."

The cap was put in place by the Health Care and Education Reconciliation Act,which takes effect this year. Students enrolling in college in 2014 or later will be able to opt for income-based repayment of their loans, allowing for a lower monthly payment.

Under existing law, borrowers must pay up to 15 percent of their income toward loans. The new initiative allows them to cap payments at 10 percent. For those who make their monthly payments for 20 years and choose this plan, the remaining balances will be forgiven at that point, according to the White House. Military personnel, teachers, nurses and other public service workers who opt for the plan will see their remaining debts forgiven after a decade.

"We're shaking up our system of higher education to give parents more information, and colleges more incentives to offer better value, so that no middle-class kid is priced out of a college education," Obama said Tuesday night. "We're offering millions the opportunity to cap their monthly student loan payments to 10 percent of their income, and I want to work with Congress to see how we can help even more Americans who feel trapped by student loan debt."

The cap was put in place by the Health Care and Education Reconciliation Act,which takes effect this year. Students enrolling in college in 2014 or later will be able to opt for income-based repayment of their loans, allowing for a lower monthly payment.

Under existing law, borrowers must pay up to 15 percent of their income toward loans. The new initiative allows them to cap payments at 10 percent. For those who make their monthly payments for 20 years and choose this plan, the remaining balances will be forgiven at that point, according to the White House. Military personnel, teachers, nurses and other public service workers who opt for the plan will see their remaining debts forgiven after a decade.

Numbers are Dire

Obama began in August to push for a new college funding model, where the financial aid available to students is linked to the institution's performance in areas such as enrolling students who qualify for Pell Grants, affordability and outcomes, such as graduation rates and graduates' earnings. The administration has begun gathering data for a new college rating system, with the goal of publishing the ratings before the start of the 2015 school year.

However, these changes don't offer relief to the millions of students already struggling to pay college debts. Among students graduating in 2012, 71 percent had student loans, and the average student debt was $29,400 for the borrowers, according to a December 2013 report by the Project on Student Debt, published by the Institute for College and Success, a nonprofit focused on increasing college access.

Sen. Kirsten Gillibrand, D-N.Y., called on Sunday upon the president to put the refinancing of student loans at the top of his priority list. She has been pushing for a measure to allow borrowers to refinance federal student loans at a lower interest rate. "Our young people should be able to refinance in the same way that our businesses and homeowners do," she said.

Although the economy has been improving, the student loan situation keeps getting worse, exacerbated by skyrocketing tuition and still-high youth unemployment. Outstanding student loans have approached $1.2 trillion, according to a May 2013estimate by the Consumer Financial Protection Bureau, up from about $1 trillion at the end of 2011.

In recent months, a growing number of students has fallen behind on monthly payments. The 90-day delinquency rate on student loans increased to 11.8 percent in the third quarter of 2013, up from 10.9 percent the previous quarter, according to the Federal Reserve Bank of New York.

Meanwhile, the rate of defaults has been climbing since the recession. In September, the Department of Education said the national default rate was 10 percent in fiscal 2011 for students in their second year of loan repayment. That's up from 9.1 percent in the previous year.

Right now, many young Americans grapple with struggles similar to the one facing Ja'Net and Jonathan Adams when they started life as a married couple several years ago. With $25,000 in debt he had racked up from attending college at Belmont Abbey College in Belmont, N.C., the two-career couple "ran into a wall," after Ja'Net got laid off from her corporate sales job in 2008. They had to strip every extra out of their budget to pay down what he owed.

While the couple is now debt-free, and Ja'Net has built a career speaking to college students about how to reduce their own student debt, she says she meets many young people so hopeless about their loans they feel like giving up. "They are starting out in the red," she said. "They need to understand how to get out of that quickly."

This is a common problem. "Many students have an unrealistic view of what they will earn the first few years out of school—and what the cost of living is—and therefore borrow more than they can realistically afford to repay," said Carrie Schwab-Pomerantz, president of the Charles Schwab Foundation, a nonprofit focused on promoting financial well-being.

To avoid getting overextended, students should follow a basic rule of thumb, Schwab-Pomerantz advises: "Don't borrow more than you realistically expect to earn the first year working." That may entail making tough choices about what college to attend, she said.

In most cases, students will be on the hook for their college debts until they are repaid, because they can't be discharged in a bankruptcy.

"Young people don't really understand the repercussions of taking on loans," said Schwab-Pomerantz. "It is a serious commitment and will affect you for many years."

"Our young people should be able to refinance in the same way that our businesses and homeowners do."-Kirsten Gillibrand, U.S. Senator (D-NY)

Many experts say more needs to be done in high schools and colleges to teach students about personal finance, so they don't find themselves drowning in debt later.

"Nowhere are they being taught how to repay those loans," said Gene Natali Jr., senior vice president of C.S. McKee, a Pittsburgh-based investment firm, and co-author of "The Missing Semester," a book on financial literacy that the University of Pittsburgh has incorporated into its curriculum to teach young people about financial planning.

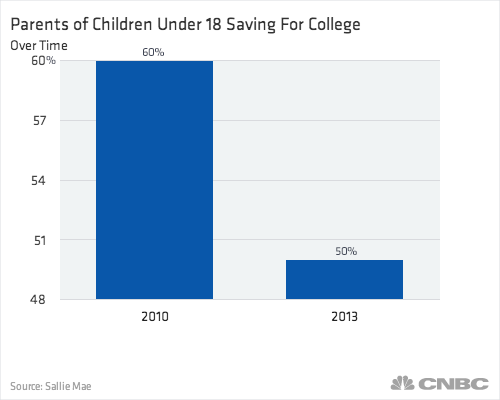

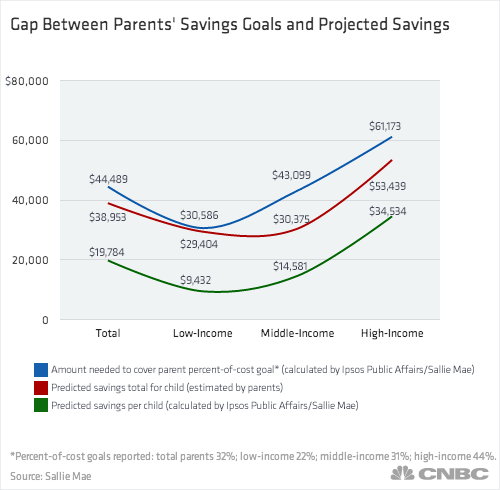

Students don't always learn about financial planning for higher education at home because many parents are in the dark, too. Sallie Mae, a financial services company that issues student loans, found in its 2013 report that only 2 in 5 parents have a plan to save for college. Even parents who were saving tended to be overly optimistic about how much they would be able to sock away. While the average parents expected to save $38,953 per child by the time each youngster reached age 18, their actual savings were more likely to hit $19,784.

Many parents said they didn't discuss paying for college with their teens in Sallie Mae's survey, even though they were counting on a student loan to cover part of the costs. Among parents of teens, 45 percent had not discussed paying for college with them, though 22 percent eventually planned to do so. In 72 percent of families, teens didn't have a separate savings account where they could contribute to college costs.

What if you find college tuition looming and haven't met your savings goals? Don't let embarrassment prevent you from getting advice from a financial planner or banker on your options, experts say. "People might be in a better position than they think they are," said Matt Chevalier, senior vice president of the retail sales strategy group at TD Bank.

Parents who try to wing it can easily make financial mistakes as disastrous as those of young people who take on student debt they can't handle for college. "Sometimes they'll turn to the wrong place. They'll jack up credit card debt," Chevalier said.

What should young people do to avoid sinking into the abyss of college debt?

According to Bob Stammers, director of investor education for CFA Institute, a global association of investment professionals, they need to establish a budget as early as possible. This will help them stay on top of their debt, given that deferring payments will only stretch out the debt and add to the total interest they end up paying. The goal is to avoid "paying interest on interest," he said. "That's why the loans balloon so fast."

However, these changes don't offer relief to the millions of students already struggling to pay college debts. Among students graduating in 2012, 71 percent had student loans, and the average student debt was $29,400 for the borrowers, according to a December 2013 report by the Project on Student Debt, published by the Institute for College and Success, a nonprofit focused on increasing college access.

Sen. Kirsten Gillibrand, D-N.Y., called on Sunday upon the president to put the refinancing of student loans at the top of his priority list. She has been pushing for a measure to allow borrowers to refinance federal student loans at a lower interest rate. "Our young people should be able to refinance in the same way that our businesses and homeowners do," she said.

Although the economy has been improving, the student loan situation keeps getting worse, exacerbated by skyrocketing tuition and still-high youth unemployment. Outstanding student loans have approached $1.2 trillion, according to a May 2013estimate by the Consumer Financial Protection Bureau, up from about $1 trillion at the end of 2011.

In recent months, a growing number of students has fallen behind on monthly payments. The 90-day delinquency rate on student loans increased to 11.8 percent in the third quarter of 2013, up from 10.9 percent the previous quarter, according to the Federal Reserve Bank of New York.

Meanwhile, the rate of defaults has been climbing since the recession. In September, the Department of Education said the national default rate was 10 percent in fiscal 2011 for students in their second year of loan repayment. That's up from 9.1 percent in the previous year.

Right now, many young Americans grapple with struggles similar to the one facing Ja'Net and Jonathan Adams when they started life as a married couple several years ago. With $25,000 in debt he had racked up from attending college at Belmont Abbey College in Belmont, N.C., the two-career couple "ran into a wall," after Ja'Net got laid off from her corporate sales job in 2008. They had to strip every extra out of their budget to pay down what he owed.

While the couple is now debt-free, and Ja'Net has built a career speaking to college students about how to reduce their own student debt, she says she meets many young people so hopeless about their loans they feel like giving up. "They are starting out in the red," she said. "They need to understand how to get out of that quickly."

This is a common problem. "Many students have an unrealistic view of what they will earn the first few years out of school—and what the cost of living is—and therefore borrow more than they can realistically afford to repay," said Carrie Schwab-Pomerantz, president of the Charles Schwab Foundation, a nonprofit focused on promoting financial well-being.

To avoid getting overextended, students should follow a basic rule of thumb, Schwab-Pomerantz advises: "Don't borrow more than you realistically expect to earn the first year working." That may entail making tough choices about what college to attend, she said.

In most cases, students will be on the hook for their college debts until they are repaid, because they can't be discharged in a bankruptcy.

"Young people don't really understand the repercussions of taking on loans," said Schwab-Pomerantz. "It is a serious commitment and will affect you for many years."

"Our young people should be able to refinance in the same way that our businesses and homeowners do."-Kirsten Gillibrand, U.S. Senator (D-NY)

Many experts say more needs to be done in high schools and colleges to teach students about personal finance, so they don't find themselves drowning in debt later.

"Nowhere are they being taught how to repay those loans," said Gene Natali Jr., senior vice president of C.S. McKee, a Pittsburgh-based investment firm, and co-author of "The Missing Semester," a book on financial literacy that the University of Pittsburgh has incorporated into its curriculum to teach young people about financial planning.

Students don't always learn about financial planning for higher education at home because many parents are in the dark, too. Sallie Mae, a financial services company that issues student loans, found in its 2013 report that only 2 in 5 parents have a plan to save for college. Even parents who were saving tended to be overly optimistic about how much they would be able to sock away. While the average parents expected to save $38,953 per child by the time each youngster reached age 18, their actual savings were more likely to hit $19,784.

Many parents said they didn't discuss paying for college with their teens in Sallie Mae's survey, even though they were counting on a student loan to cover part of the costs. Among parents of teens, 45 percent had not discussed paying for college with them, though 22 percent eventually planned to do so. In 72 percent of families, teens didn't have a separate savings account where they could contribute to college costs.

What if you find college tuition looming and haven't met your savings goals? Don't let embarrassment prevent you from getting advice from a financial planner or banker on your options, experts say. "People might be in a better position than they think they are," said Matt Chevalier, senior vice president of the retail sales strategy group at TD Bank.

Parents who try to wing it can easily make financial mistakes as disastrous as those of young people who take on student debt they can't handle for college. "Sometimes they'll turn to the wrong place. They'll jack up credit card debt," Chevalier said.

What should young people do to avoid sinking into the abyss of college debt?

According to Bob Stammers, director of investor education for CFA Institute, a global association of investment professionals, they need to establish a budget as early as possible. This will help them stay on top of their debt, given that deferring payments will only stretch out the debt and add to the total interest they end up paying. The goal is to avoid "paying interest on interest," he said. "That's why the loans balloon so fast."